What Does Trading Indicator Do?

Trading Indicator Things To Know Before You Get This

Table of ContentsThe Best Guide To Trading IndicatorA Biased View of Trading IndicatorTrading Indicator Fundamentals ExplainedNot known Details About Trading Indicator Some Known Factual Statements About Trading Indicator Not known Facts About Trading Indicator

If you're obtaining a 'get' signal from an indicator and also a 'sell' signal from the cost action, you need to make use of different signs, or various amount of time till your signals are confirmed. An additional point to bear in mind is that you have to never lose view of your trading plan (TRADING INDICATOR). Your guidelines for trading need to always be carried out when using signs.Or, if you prepare to begin trading, open a online account.

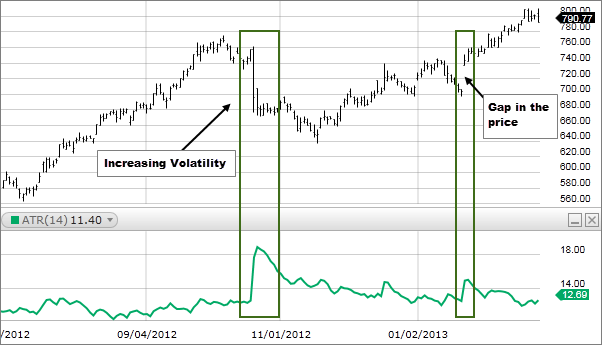

demonstrate how much of an asset has been traded over a period (e. g., an hour, a day, a week). Each time period has an equivalent bar. The size of the bar will indicate the quantity traded. A green bar shows a price increase throughout the duration, and a red bar shows a rate decrease.

The Main Principles Of Trading Indicator

High volumes may indicate that a movement in price is substantial, while low quantities might show that a movement in rate is insignificant. shows the ordinary closing cost over an amount of time. For instance, any given factor on a 20-day relocating standard shows the standard of all shutting prices from the previous 20 days.

It can also help in reducing the influence of short-term price variations. By contrasting MAs for different time durations, experts may have the ability to determine price fads with time. resembles the moving standard (MA). Both show the average closing rate over an amount of time. Nevertheless, unlike MA, EMA places even more weight on recent information.

Analysts generally compare EMAs for various time durations to help identify whether price fads will continue. This implies that it analyzes the price at which prices climb as well as drop.

Trading Indicator Can Be Fun For Anyone

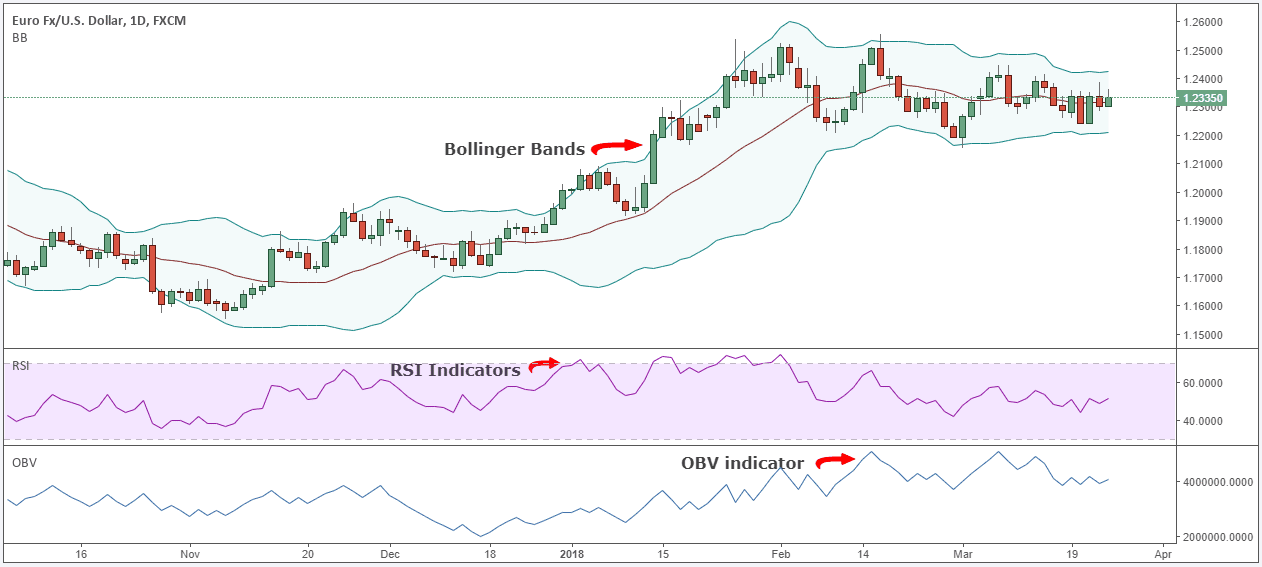

Analysts generally think about a property overbought if its RSI is over 70, and oversold if its RSI is below 30. Our RSI uses, which aids filter out cost changes to make it simpler to detect trends. As opposed to comparing costs to the relocating average (MA), Wilder's smoothing uses the rapid moving average (EMA).

Indicators are a collection of devices put on a trading graph that assist make the marketplace more clear. They can confirm if the market is trending or if the market is varying. Indicators can likewise offer particular market details such as when a property is overbought or oversold in a variety, and due for a turnaround.

Leading signs can supply signals in advance, while lagging indicators are normally made use of to verify the price action, such as the stamina of a trend. If the price activity has actually quickly climbed and then begins to slow, a leading sign can register this modification in momentum and also hence provide a signal that the property might be due for a turnaround.

The Definitive Guide for Trading Indicator

They are called lagging indicators since they hang back the price activity. Indicators generate trading signals as well as each indication does this in a different way depending on webpage how the sign determines the cost action to supply the signal. They fall right into two more categories: Trending indications that function best in trending markets Oscillating/ranging indications that work best in ranging markets The pattern on a chart, along with its stamina, is not constantly apparent as well as a trending indication can make this clearer.

Trending indications tend to be lagging in nature and are used to identify the stamina of a trend, as well as assist locate entrances and also leaves in as well as out of the marketplace. Trending indications can as a result enable an investor to: Identify whether the marketplace is in a fad Establish the instructions as well as toughness of that trend Assistance find access and also leaves into as well as out of the marketplace When the rate is moving in a variety, an oscillating indication helps to determine the upper and reduced boundaries of that variety by showing whether something is overbought or oversold (TRADING INDICATOR).

The Ultimate Guide To Trading Indicator

The type of indications being made use of depends on the trading system, and also eventually boils down to the preference of the trader. The kind internet of sign you utilize depends on the trader's choice; nonetheless oscillating indications are valuable in ranging markets, while trending indications serve in trending markets. As an example, if you favor to trade in ranging markets, after that oscillating signs, such as the stochastic, product network index or the family member toughness index, will certainly work to help make trading decisions.

Integrating trending as well as oscillating signs to utilize in different market problems is valuable. Market conditions consistently transform from ranging to trending as well as back again, and so you can make use of each sign according to its toughness. In a ranging market, the oscillating sign stochastic is much more valuable In a trending market, the trending indication relocating standard is extra beneficial Once it ends up being clear exactly how helpful signs can be, there can be a propensity to make use of way too many signs on one chart.

Getting My Trading Indicator To Work

there are many types of indications, each with their very own objective and also advantage ... a lagging indication will certainly confirm the marketplace problems, whereas a leading indication can supply trading signals for future rate activity ... trending indicators can aid determine whether the marketplace has actually participated in a pattern as well as the toughness of that pattern ...By Chainika Thakar The moving standard or MA is a technical sign utilized for validating the motion of markets. Only a few other indications have verified to be as honest, definitive as this website well as practical as the relocating average. The moving ordinary trading helps investors recognize patterns that increase the number of good professions.